Labor

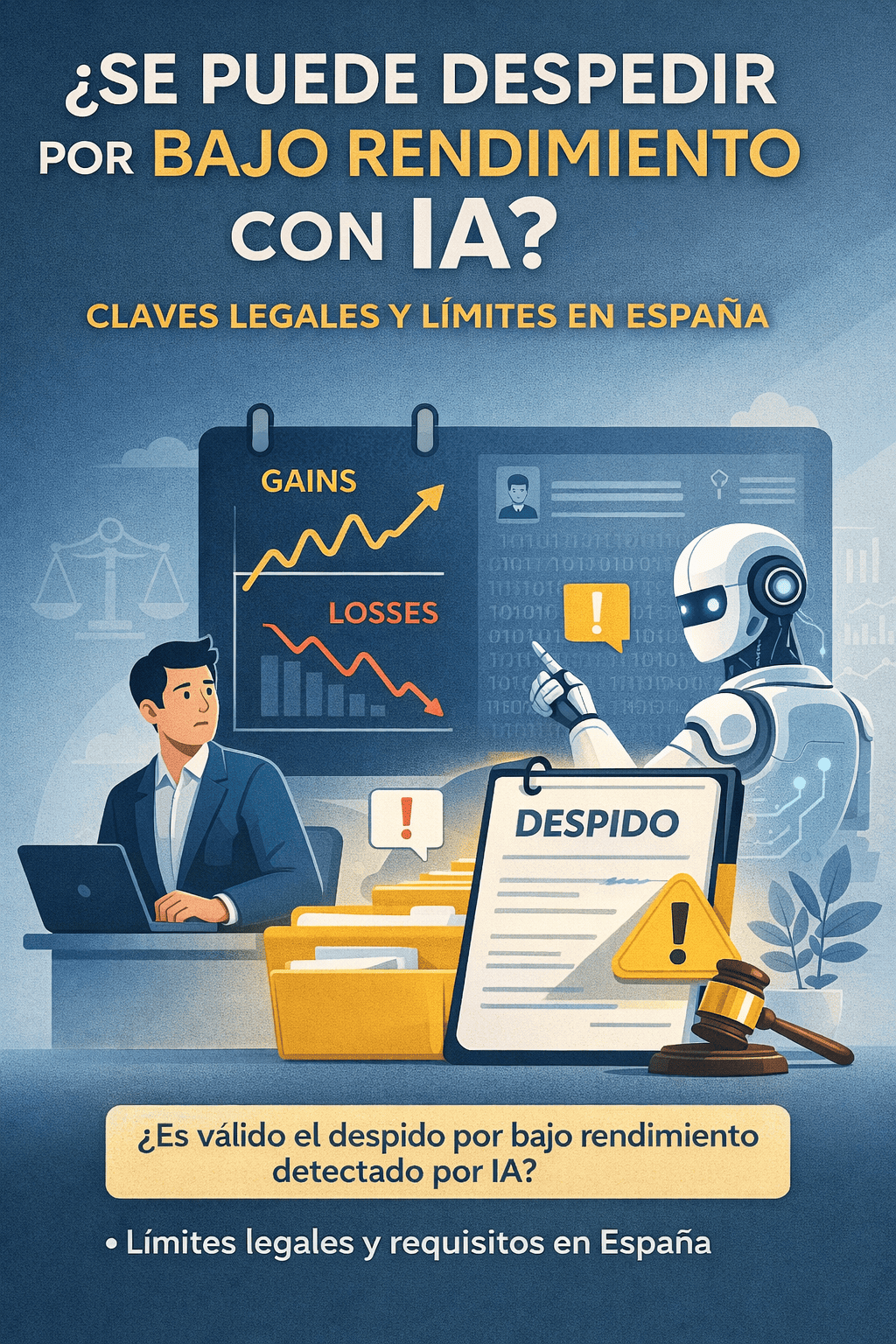

Labor Can You Be Dismissed for Low Performance Using AI? Legal Keys and Limits in Spain

We analyze whether it is possible in Spain to dismiss an employee for low performance detected through artificial intelligence. Legal limits, requirements, and the real role of AI under the Workers’ Statute.

Read More