Annual accounts filing and book legalisation in Spain: deadlines, penalties and how to avoid a Registry block

For startups, corporate housekeeping often sits behind product, revenue, fundraising and hiring. The issue is that Spanish corporate compliance has two recurring obligations that do not stay in the “we will do it later” bucket. If you neglect them, you can end up with a Commercial Registry block, economic penalties, and serious friction in funding rounds, audits, banking and procurement.

The two key obligations are:

- Filing (depositing) annual accounts with the Commercial Registry.

- Legalising mandatory corporate and accounting books (books “legalisation”).

These obligations apply broadly in Spain (startups and traditional SMEs alike). What changes is the practical impact: a Registry block can stop the transactions startups need most (capital increases, director changes, powers of attorney, option plans, due diligence).

This guide explains what to do, when to do it, what happens if you miss deadlines, and how to prevent issues.

Main legal references (Spanish):

LSC (Companies Act, consolidated): https://www.boe.es/buscar/act.php?id=BOE-A-2010-10544

Commercial Code: https://www.boe.es/buscar/act.php?id=BOE-A-1885-6627

RD 2/2021 (ICAC penalty criteria): https://www.boe.es/buscar/act.php?id=BOE-A-2021-1351

LGT (tax formal obligations and penalties): https://www.boe.es/buscar/act.php?id=BOE-A-2003-23186

1) Annual accounts filing: what it is and why it matters

In Spain, companies must file their annual accounts with the Commercial Registry. This is part of the transparency model: accounts become publicly accessible and the Registry records compliance.

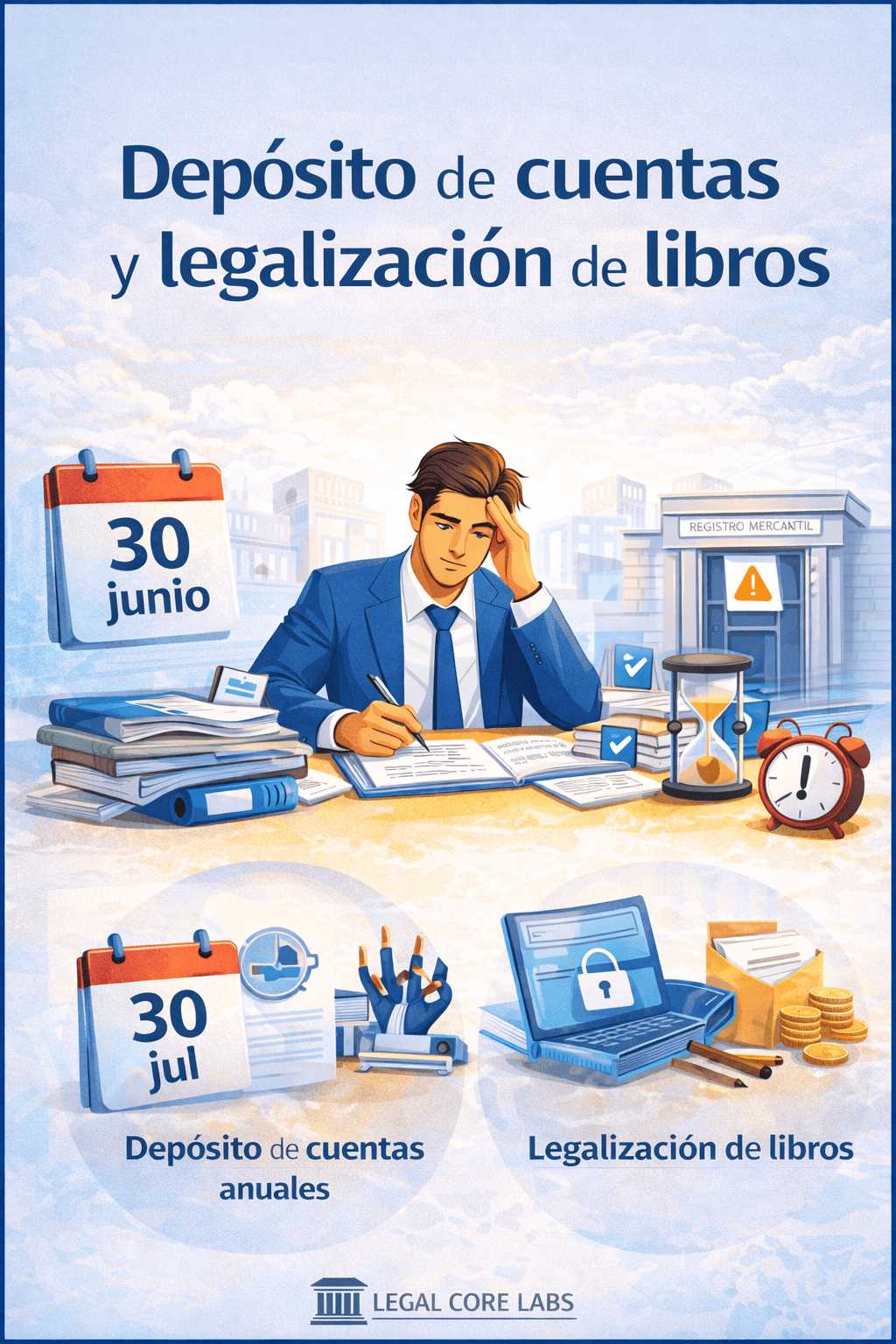

Deadlines (the real-world timeline)

If your financial year ends on 31 December, a typical calendar is:

- Preparation of accounts by directors: within 3 months after year-end (LSC).

- Shareholders’ approval: within the first 6 months after year-end (LSC).

- Filing with the Registry: within 1 month after approval (LSC).

Practical rule: if approval happens on 30 June, aim to file before 31 July.

What you normally file (practical view)

Depending on company size and audit requirements, filings typically include:

- Shareholders’ resolution certificate (accounts approval and profit allocation).

- Annual accounts (balance sheet, P&L, notes and other statements depending on the applicable model).

- Management report where applicable.

- Audit report where the company is audited or has an appointed auditor.

2) Missing the filing deadline: Registry block and fines (two separate impacts)

A) Commercial Registry block (no registrations until you fix it)

If you fail to file, Spanish law can trigger a Registry block. While non-compliance persists, the Registry will generally refuse to register company documents (LSC).

This affects typical startup actions:

- capital increases and reductions

- bylaw amendments

- director appointments and renewals

- powers of attorney for executives and sales teams

- corporate restructurings and M&A steps

Key exceptions: certain entries may still be registered (for example, director resignations/removals, revocation/renunciation of powers, dissolution and liquidation related entries, and entries ordered by a court or public authority).

B) ICAC fines: 1,200 to 60,000 euros (up to 300,000 in some cases)

In addition to the block, there is a sanction regime. The statutory range is 1,200 to 60,000 euros (LSC). If the company (or group) exceeds 6,000,000 euros in annual turnover, the maximum can rise to 300,000 euros per year of delay (LSC).

How the fine is calculated (regulatory criteria)

Royal Decree 2/2021 provides practical criteria often applied in proceedings:

- 0.5 per mille of total assets + 0.5 per mille of turnover (based on the last filed tax return, typically requested during the procedure).

- If the company does not provide tax information: the fine can be set at 2% of the share capital (based on Registry data).

For most startups, the bigger risk is not only the fine, but the Registry block and the reputational impact in fundraising and due diligence.

3) Book legalisation: what it is and which books are included

Spain requires companies to keep mandatory books and to legalise them through the Commercial Registry (today, largely electronic and submitted telematically).

Core deadline: 4 months after year-end

The Commercial Code sets a key timing requirement: mandatory books must be legalised within 4 months after the end of the financial year. If year-end is 31 December, the practical deadline is 30 April.

What an SL typically legalises (practical list)

For a Spanish private limited company (SL), this usually includes:

Accounting books

- Journal (Libro Diario)

- Inventory and Annual Accounts Book (Libro de Inventarios y Cuentas Anuales)

Corporate books

- Minutes book (shareholders’ meetings and, where applicable, board/collegiate body)

- Shareholder register (Libro Registro de Socios)

In single-member structures, an additional “contracts with the sole shareholder” register can be relevant where applicable.

4) Late or missing book legalisation: what can happen

It helps to distinguish corporate consequences from tax risk.

A) Corporate consequence (late filing is recorded)

If you legalise books late, the Registry typically records that the submission is out of time. This is not always an automatic monetary fine, but it can create friction in:

- due diligence and investor scrutiny

- shareholder disputes and litigation

- evidentiary discussions around dates and resolutions

B) Tax risk (LGT)

Spain’s General Tax Law (LGT) includes formal obligations and penalties tied to accounting and registers. In audits or disputes over accounting reliability, missing or poorly maintained books can worsen your position and may expose the company to sanctions.

5) Common startup scenarios

Scenario 1: “We need a capital increase and the Registry refuses”

Accounts are not filed. You try to register a capital increase for investors. The Registry block prevents registration until you regularise.

Scenario 2: “Due diligence reveals missing or late legalised books”

Books were not legalised on time. Investors ask for additional warranties, indemnities, or holdbacks, because corporate hygiene is not “deal ready”.

Scenario 3: “We did not file because accounts were not approved”

Shareholder conflict blocks approval. Filing is delayed and the Registry block risk increases exactly when the company needs flexibility.

6) Best practices (a checklist that works)

1) Use a compliance calendar and avoid last-minute execution

- Do not push preparation to day 90.

- Prepare book legalisation before late April (for 31 December year-ends).

- Schedule the ordinary meeting earlier than late June.

- Treat the one-month filing window after approval as non-negotiable.

2) Assign a clear owner

If everyone owns it, no one owns it. Assign it to finance (CFO), operations, or an external advisor with internal follow-up.

3) Prepare the Registry “filing pack” early

Signatures, certificates, financial statements, management report and audit report where applicable.

4) If you are late, regularise quickly (unblock operations)

Opportunity cost (fundraising, banking, powers, corporate actions) usually exceeds administrative costs.

5) Do not underestimate evidentiary value

Late legalisation and weak corporate records can become expensive in disputes or transactions.

FAQ

When must annual accounts be filed in Spain?

Within one month after shareholder approval (LSC).

When must accounts be approved?

Within the first six months after year-end (LSC). Late meetings may still be valid, but non-compliance creates risk.

What happens if we fail to file accounts?

A Commercial Registry block can prevent registrations and the ICAC may impose fines (LSC).

Is the Registry block total?

No. Certain entries can still be registered (for example, director resignations/removals, revocation of powers, dissolution and liquidation, and court-ordered entries).

When must books be legalised?

Within 4 months after year-end (Commercial Code).

Is there an automatic fine for late legalisation?

Not necessarily as a direct corporate fine, but the Registry record and the associated tax and evidentiary risks can be material.

Need to put your corporate calendar under control, regularise overdue filings, or get your company “due diligence ready” for investors?

At Legal Core Labs we help startups and tech companies in Spain with annual compliance planning, Registry filings and risk prevention so corporate housekeeping does not slow down the business.