How to Optimize Your Tax Burden When Managing a Significant Portfolio of Rental Properties

Real estate taxation can become a major challenge when an individual or company manages multiple rental properties.

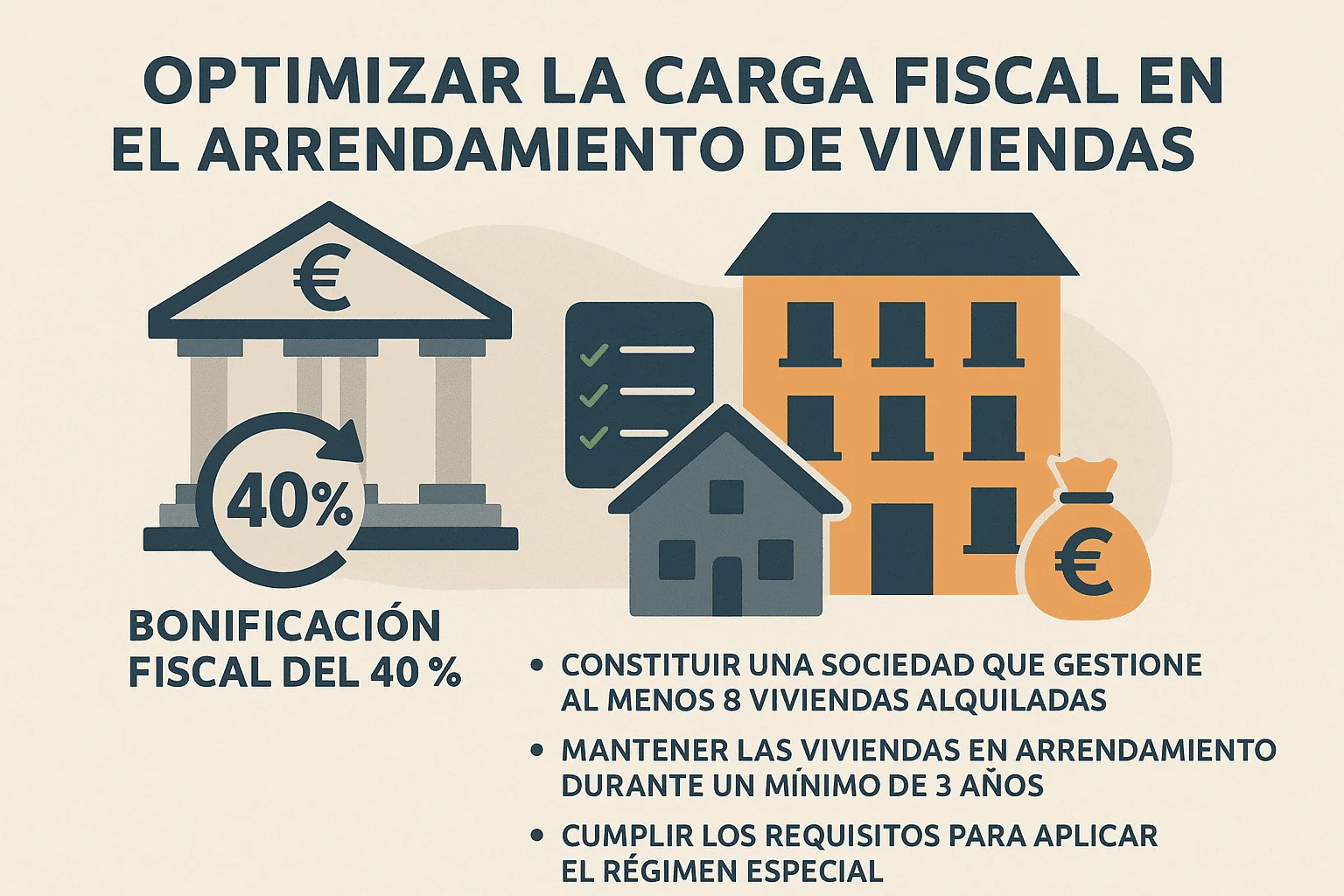

The Special Regime for Entities Dedicated to Residential Leasing (EDAV), regulated under the Spanish Corporate Income Tax Law, offers very attractive tax advantages for those who professionalize the management of residential rental portfolios.

1. What Is an EDAV?

An EDAV is a commercial company that meets specific requirements in order to apply a special tax regime.

Its goal is to promote professional residential leasing and grant tax benefits in exchange for commitments related to property management and maintenance.

Main requirements:

- Own at least 8 dwellings rented out or offered for rent continuously.

- Keep the properties rented for a minimum period of 3 years.

- The main activity of the entity must be residential leasing, representing at least 55% of income or asset value.

- Properties cannot be rented to shareholders with significant ownership or related parties.

2. Tax Advantages of the EDAV Regime

The main benefit of this regime is a 40% tax reduction on the portion of the Corporate Income Tax liability corresponding to income derived from residential leasing.

💡 In practice, this means an effective tax rate close to 15% on such income, compared to the general 25% rate.

⚠️ Income from the rental of non-residential assets (such as commercial premises or standalone garages) is not eligible for the reduction.

3. Impact on Cash Flow

Applying the EDAV regime directly improves the company’s liquidity:

- Significant reduction in the annual tax burden.

- More cash available to reinvest in new acquisitions or renovations.

- Increased net profitability of the rental business.

💰 Fewer taxes = more liquid resources for growth.

4. Practical Example

Let’s assume a company with 20 rental properties generating €400,000 in annual income, with €100,000 in deductible expenses.

- Taxable base: €300,000

- Tax under the general regime (25%): €75,000

- Tax under the EDAV regime (40% reduction):

- Total tax liability on residential rental income: €75,000

- 40% reduction: −€30,000

- Final tax due: €45,000

📊 Result: a tax saving of €30,000, immediately improving the company’s cash flow.

5. Strategy and Key Considerations

To correctly apply the EDAV regime:

- Set up a company to manage rental properties if the requirements are met.

- Maintain a minimum number of active rental properties.

- Comply with the required holding period to preserve eligibility for the tax reduction.

- Keep clear and separate accounting records to distinguish eligible rental income from other income.

- Seek specialized tax advice, as the Spanish Tax Agency closely monitors compliance with this regime.

6. Conclusion

The EDAV regime is a powerful tool for those managing large residential rental portfolios.

Its main advantage —the 40% Corporate Income Tax reduction— allows you to:

✅ Optimize your tax burden.

✅ Increase profitability.

✅ Improve business cash flow.

However, it requires professional management and strict compliance with the legal requirements to avoid tax risks and maintain the benefits of the regime.