Can I Use Images or Content from the Internet on My Website or Social Media?

Can I use Google images on my website? Find out what the Intellectual Property Law says and how to avoid penalties for misuse of visual content.

Read more →

In almost every startup investment round in Spain, especially from seed stage onwards, there is one clause that appears regularly in shareholders’ agreements and that many founders accept without fully understanding its consequences: anti-dilution clauses.

These clauses are far from a technical detail. Poorly drafted or poorly negotiated, they can lead to significant equity loss for founders, distort the balance between shareholders, and even block future funding rounds. Properly structured, however, they can act as a reasonable investor protection mechanism without jeopardising the company’s growth.

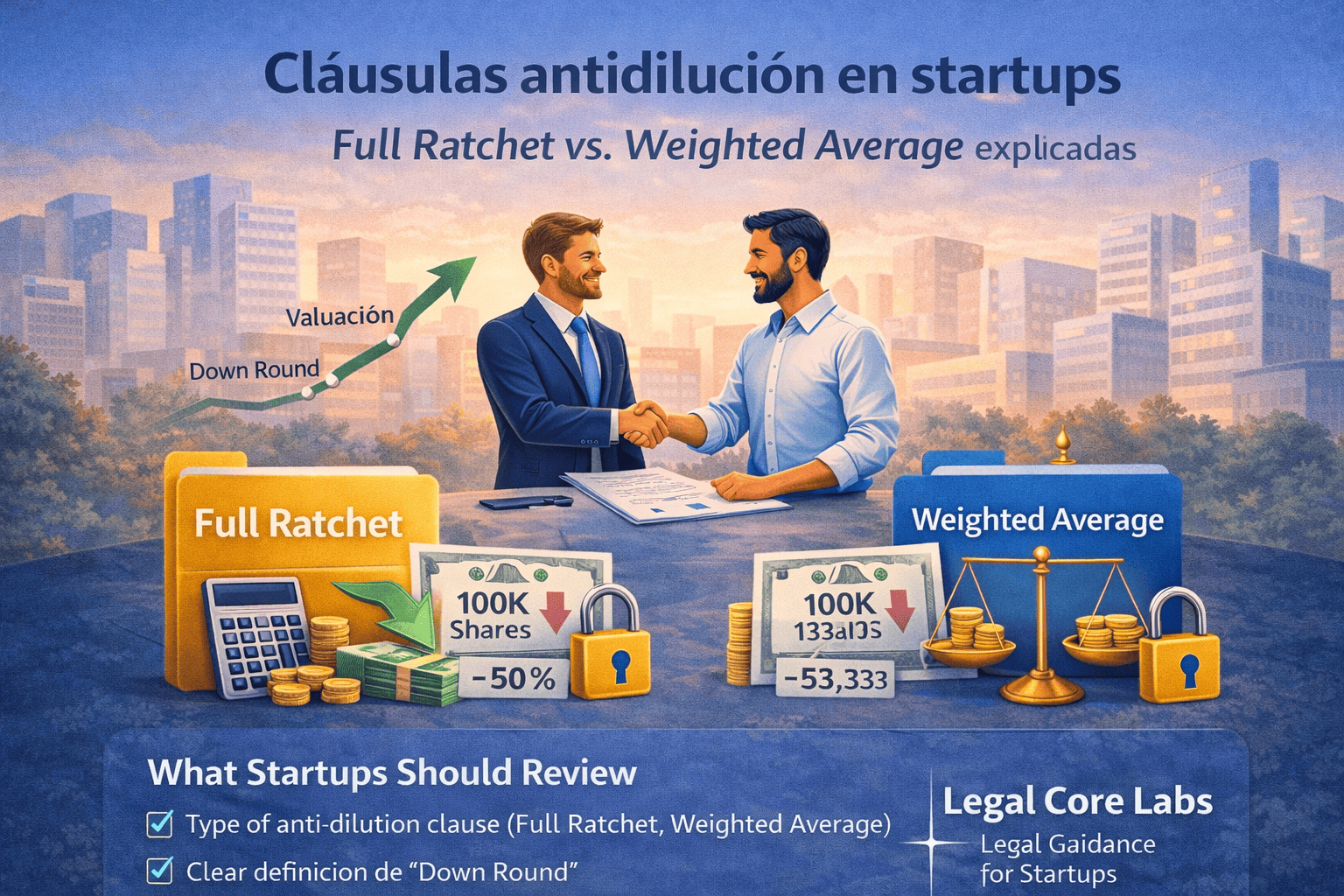

In this article, we explain from a legal and practical perspective what anti-dilution clauses are, how the two most common models (Full Ratchet and Weighted Average) work, and what startups should carefully review before accepting them under Spanish law.

An anti-dilution clause is a contractual mechanism designed to protect certain investors when the company carries out a future financing round at a lower valuation than the one at which those investors initially invested (a so-called down round).

Its purpose is to prevent the investor from seeing the economic value of their stake reduced due to that lower valuation. To achieve this, the clause allows the investor to receive additional shares or participations, adjusting the effective price of their original investment.

From a legal standpoint, there are two key clarifications:

In practice, these clauses usually benefit professional investors, such as venture capital funds or experienced business angels, and are not applied equally to all shareholders.

Although there are variations, the Spanish startup ecosystem generally relies on two main types of anti-dilution clauses. The difference between them is critical for founders.

The Full Ratchet clause offers the strongest level of protection to the investor.

If a down round occurs, the price at which the protected investor originally invested is fully adjusted to the new lower price, regardless of the size of the round or the number of new shares issued.

In practical terms, this means the investor is treated as if they had invested from day one at the lowest valuation. To achieve this adjustment, the company must issue additional shares to that investor, which results in direct dilution of the remaining shareholders.

Practical consequences for startups:

For these reasons, Full Ratchet clauses are usually seen only in situations of significant bargaining imbalance or urgent funding needs.

The Weighted Average clause is the most common and market-standard approach.

Instead of fully resetting the investor’s entry price, this model calculates a new weighted average price, taking into account:

The adjustment is therefore partial: the investor receives additional shares, but the dilution impact is shared proportionally among shareholders.

There are two main variants:

In Spain, broad-based weighted average clauses are widely regarded as the reasonable market standard in professional investment rounds.

When reviewing shareholders’ agreements, Legal Core Labs focuses on several critical risk points that founders should never overlook.

Simply stating “anti-dilution” is not enough. The agreement must clearly specify whether it is Full Ratchet or Weighted Average and, in the latter case, which formula applies.

The triggering events must be precisely defined, including exclusions for technical capital increases, option plans, bridge rounds or convertible instruments.

Running realistic dilution scenarios is essential. A 20 %, 30 % or 50 % valuation drop can produce very different outcomes depending on the clause.

Provisions such as pay-to-play, which require investors to participate in future rounds to maintain protection, help align incentives and avoid opportunistic behaviour.

Overly aggressive anti-dilution clauses often discourage new investors and can become a structural obstacle to growth.

In Spain, anti-dilution mechanisms are usually implemented through:

This makes it essential to ensure consistency between the shareholders’ agreement and the company’s articles of association, avoiding structures that are legally unenforceable or prone to dispute.

Anti-dilution clauses are not inherently problematic. They are legitimate tools in high-risk investment environments. Issues arise when founders accept them without understanding their real legal and economic impact.

For startups, the key is to:

At Legal Core Labs, we help founders and investors structure and negotiate shareholders’ agreements that comply with Spanish law and are designed to scale sustainably.

If you are preparing a funding round or reviewing an investment term sheet, understanding anti-dilution clauses before signing can make a decisive difference.