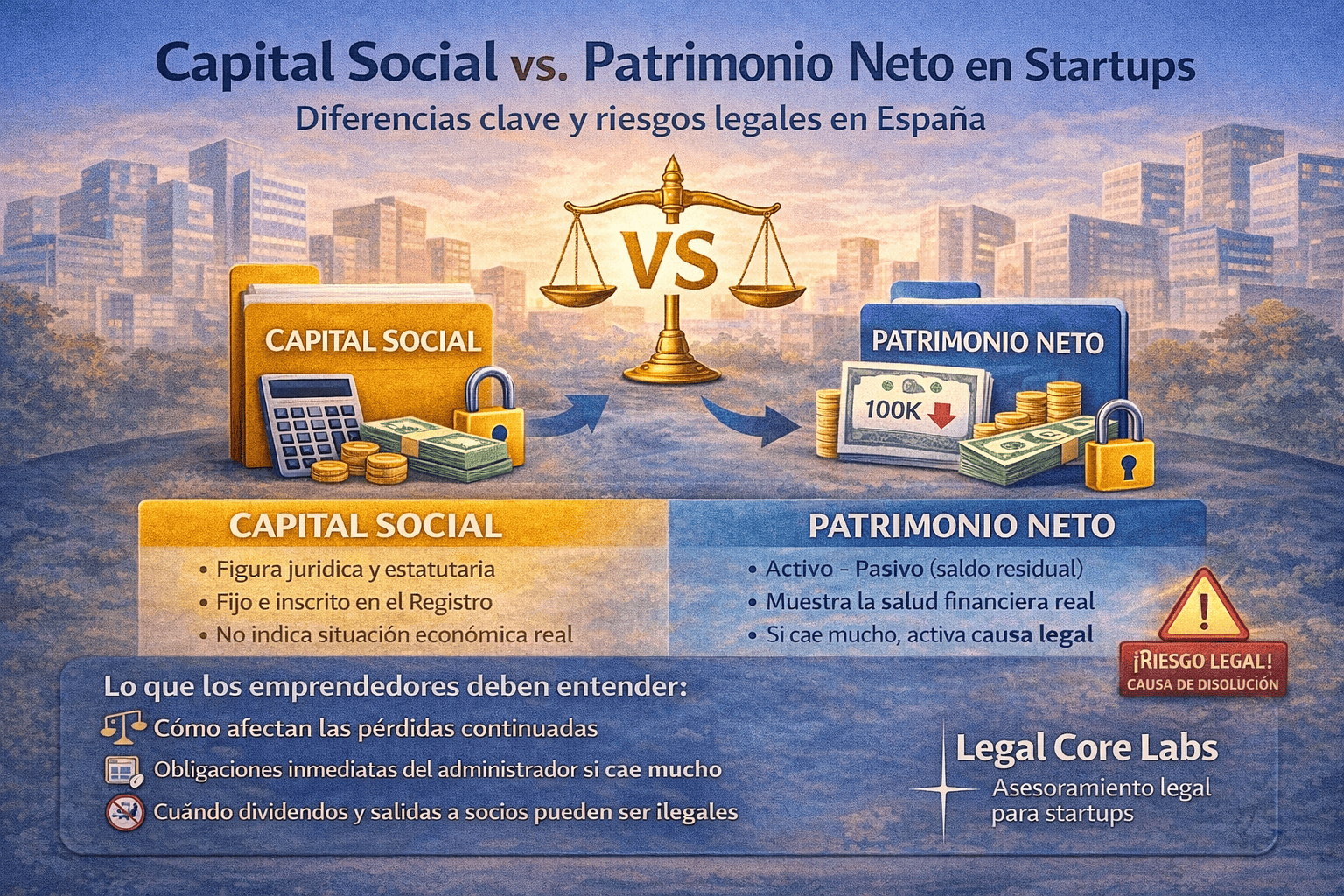

Share capital vs net equity in startups: legal differences, risks and how to manage them in Spain

In the startup ecosystem, concepts such as equity, valuation or funding rounds are used on a daily basis. However, one of the most common (and dangerous) confusions in Spain is assuming that share capital and corporate equity are the same thing.

They are not.

And the difference is not merely accounting-related. Under the Spanish Companies Act (Ley de Sociedades de Capital – LSC), this distinction has direct legal consequences that founders and directors must understand to (i) design the company properly from day one, (ii) anticipate risks during growth, and (iii) comply with their legal duties when losses arise. In particular, articles 1, 23, 58–59, 274 and 363.1.e LSC are especially relevant.

1. Key concepts: what is share capital and what is corporate equity?

Share capital: a legal, statutory and registered figure

Share capital is the fixed amount representing the value of the contributions made by shareholders at incorporation (and through subsequent capital increases or reductions). From a legal standpoint:

- It must be stated in the articles of association and registered publicly (art. 23 LSC).

- It consists of shareholders’ contributions (art. 58 LSC).

- Contributions of work or services are not allowed as share capital (art. 58.1 LSC).

- It can only be modified through formal capital increase or reduction procedures (arts. 295 and 317 et seq. LSC).

From an accounting perspective, share capital is recorded as part of equity under the Spanish General Accounting Plan (PGC), account (100) Share capital, within group 1 “Basic financing”.

Corporate equity: the economic reality of the company

Corporate equity reflects the company’s economic reality, meaning all its assets, rights and obligations.

Under the PGC framework:

- Assets are controlled resources.

- Liabilities are present obligations.

- Net equity represents the residual interest of owners after deducting liabilities from assets.

It is crucial to distinguish:

- Corporate equity (broad sense): the company’s overall economic structure (assets and liabilities).

- Net equity: Assets − Liabilities, which includes share capital, reserves and accumulated results.

Net equity is the key indicator for assessing financial health and legal risk.

2. Why this distinction matters for startups

Startups frequently:

- set share capital for reputational reasons,

- underestimate early losses,

- or fail to monitor net equity until problems arise.

This is risky because share capital is static and formal, while net equity is dynamic and reflects the company’s real financial situation. A startup may have a high share capital and still be legally vulnerable due to accumulated losses.

3. The legal role of share capital: structure and creditor protection

Share capital:

- Determines the allocation of political and economic rights (voting, dividends, liquidation proceeds).

- Serves as a reference point for creditor protection rules.

From a legal perspective, it operates as an indirect guarantee: it cannot be freely returned to shareholders outside legally regulated mechanisms. This explains dividend distribution limits and mandatory reserves, particularly the legal reserve (art. 274 LSC).

4. Using share capital: allowed, but not without consequences

Although share capital is a legal figure, the funds contributed are reflected as assets (cash, fixed assets, etc.) and are used in day-to-day operations.

The real risk appears when:

- losses reduce net equity significantly, or

- resources are transferred to shareholders directly or indirectly.

At that point, the law imposes obligations on the company and its directors.

5. Legal risks: when net equity triggers consequences

5.1. Grounds for dissolution due to losses (art. 363.1.e LSC)

If losses reduce net equity to less than half of the share capital, and no corrective measures are adopted, a statutory ground for dissolution arises (art. 363.1.e LSC).

This does not mean automatic dissolution, but it does trigger mandatory action:

- Directors must convene a shareholders’ meeting within the statutory timeframe (arts. 364 et seq. LSC).

- Failure to act may lead to directors’ liability.

5.2. Capital below the legal minimum

Another scenario occurs when, after losses or restructuring, share capital falls below the legal minimum. In such cases, corrective corporate measures must be adopted in accordance with Spanish company law.

5.3. Dividend distribution limits (arts. 273–274 LSC)

Even if the company shows accounting profits, dividends may not be distributed if legal requirements are not met:

- profits must be distributable,

- mandatory reserves must be allocated (art. 274 LSC),

- and capital maintenance rules must be respected.

For startups, this is particularly relevant when early distributions or disguised payments to shareholders are considered.

6. Net equity as the true financial thermometer

While share capital plays a structural role, net equity shows whether the company can:

- meet its obligations,

- remain solvent,

- continue operations,

- or is approaching a legally sensitive imbalance.

Strategic decisions such as fundraising, expansion or hiring should always take net equity into account.

7. Measuring equity health: useful ratios for founders

Without going deep into technical analysis, some commonly used ratios derived from PGC-compliant financial statements include:

- General solvency ratio = Assets / Liabilities.

- Financial autonomy ratio = Net equity / Total liabilities.

- Capital coverage ratio = Net equity / Share capital.

The latter is especially useful to anticipate potential issues under art. 363.1.e LSC.

Conclusions

Understanding the difference between share capital and corporate equity allows startups to make better legal and strategic decisions:

- Share capital is a legal and statutory figure that structures the company and supports creditor protection rules (arts. 23, 58–59, 273–274 and 363.1.e LSC).

- Corporate equity, and especially net equity, reflects the real financial situation and legal stability of the company.

- Losses affecting net equity can trigger statutory obligations and dissolution risk if not addressed in time.

In short: share capital provides structure; net equity determines survival.

FAQ (Frequently Asked Questions)

1) Are share capital and corporate equity the same?

No. Share capital is a fixed legal figure registered in the articles of association. Corporate equity reflects the economic reality of the company. The key indicator is net equity.

2) Is share capital money that cannot be used?

No. Contributions are reflected as assets and can be used in operations. Legal risk arises when losses significantly reduce net equity.

3) What happens if net equity drops significantly?

A statutory ground for dissolution due to losses may arise if net equity falls below half of share capital (art. 363.1.e LSC), unless corrective measures are taken. Directors must act promptly.

4) Does a ground for dissolution mean automatic closure?

No, but it requires immediate action. Failure to convene a shareholders’ meeting and adopt measures can expose directors to liability.

5) Can dividends be distributed if there are accounting profits?

Not always. Distribution is subject to legal limits, mandatory reserves and capital maintenance rules (arts. 273–274 LSC).

6) Why should startups care about this from day one?

Because it affects corporate design, fundraising, capital operations and risk prevention related to dissolution and directors’ duties.

7) What measures are usually adopted to restore equity balance?

Common measures include shareholders’ contributions, capital increases, capital reductions due to losses, or other structural operations. The key is acting early and documenting decisions properly.